Swiggy HDFC Bank Credit Card: A Detailed Review

Swiggy HDFC Bank Credit Card: A Comprehensive Review

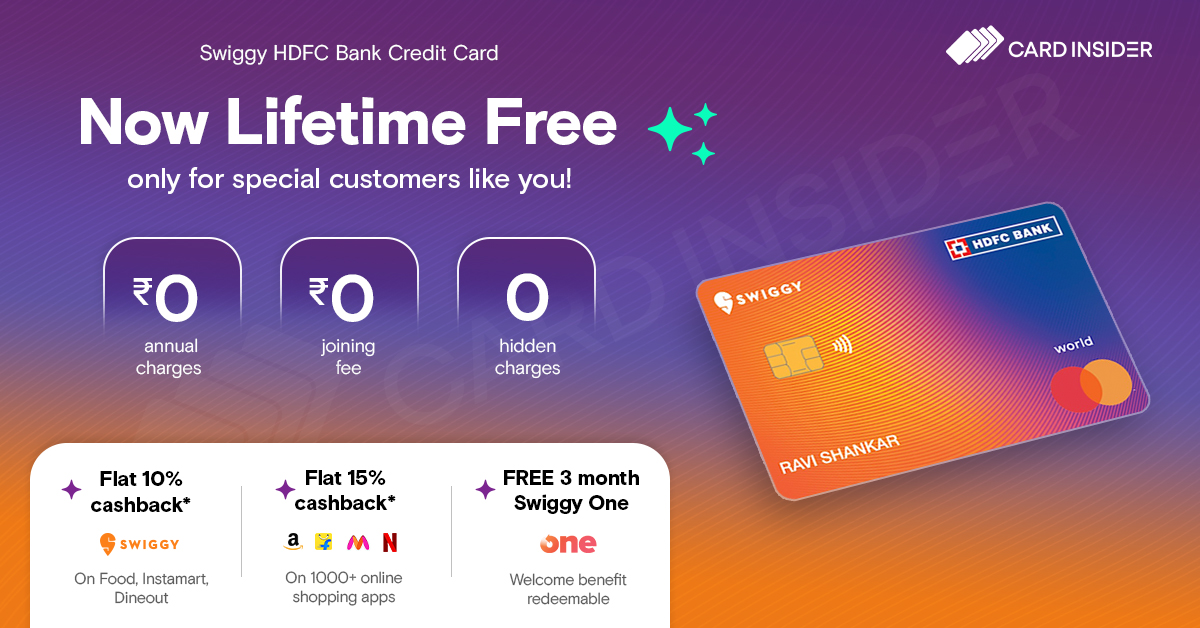

The Swiggy HDFC Bank Credit Card is a co-branded credit card offering attractive cashback rewards for Swiggy users and online shoppers. This detailed review will explore its features, benefits, drawbacks, and help you determine if it's the right card for your needs.

Key Features and Benefits

The Swiggy HDFC Bank Credit Card boasts several compelling features:

- 10% Cashback on Swiggy: Earn 10% cashback on all Swiggy spends, including food orders, Instamart, Dineout, and Genie. This is capped at ₹1500 per billing cycle and excludes Swiggy Money Wallet, Swiggy Minis, and Swiggy Liquor transactions, as well as transactions under ₹100.

- 5% Cashback on Online Spends: Get 5% cashback on online purchases from various top brands across categories like apparel, electronics, entertainment, home decor, department stores, personal care, pharmacies, local cabs, pet stores, and discount stores. This is also capped at ₹1500 per billing cycle and excludes gift cards and grocery purchases.

- 1% Cashback on Other Spends: Earn 1% cashback on all other spending categories, up to a maximum of ₹500 per billing cycle. Exclusions include fuel, rent, wallet transactions, EMIs, jewellery, and government transactions.

- Direct Cashback Credit: Cashback is credited directly to your credit card statement, reducing your bill. (Effective June 21, 2024)

- Welcome Benefit: Enjoy a complimentary 3-month Swiggy One membership upon card activation.

- Mastercard World Tier Benefits: Access various benefits, including golf privileges (four free rounds of green fees and twelve free golf lessons annually).

- Add-on Cards: Get up to 3 complimentary add-on cards.

- Zero Liability on Lost Cards: No liability for fraudulent transactions if reported immediately.

Fees and Charges

| Fee/Charge | Amount |

|---|---|

| Joining Fee | ₹500 + taxes |

| Renewal Fee | Waived on spending ₹2 Lakhs annually |

| Foreign Currency Markup | 3.5% + GST |

| Cash Advance Charges | 2.5% of the amount or ₹500, whichever is higher |

Swiggy HDFC Bank Credit Card Use Cases

Let's illustrate the card's value with some real-world examples:

| Scenario | Spending Category | Amount | Cashback Earned |

|---|---|---|---|

| Weekly Swiggy Food Orders | Swiggy | ₹3000 | ₹300 (10%) |

| Monthly Online Shopping Spree | Online Shopping (e.g., Myntra) | ₹10000 | ₹500 (5%) |

| Grocery Shopping (Flipkart) | Online Shopping (potentially 5%) | ₹5000 | Potentially ₹250 (5%)* |

| Other Expenses (Utilities, Entertainment) | Other | ₹5000 | ₹50 (1%) |

*Cashback on grocery purchases from platforms like Flipkart is not explicitly confirmed and may depend on the Merchant Category Code (MCC).

Drawbacks

- Lack of airport lounge access.

- Cashback caps on each spending category.

- Specific exclusions apply to cashback offers.

Recommendations

The Swiggy HDFC Bank Credit Card is a great option for:

- Frequent Swiggy users who can maximize the 10% cashback on food delivery, Instamart, and other Swiggy services.

- Online shoppers who regularly purchase from the eligible brands.

- Individuals who value a simple cashback rewards program with direct statement credits.

However, if you prioritize airport lounge access or require a card with higher cashback rates on a broader range of categories, you might consider exploring alternative options.

Disclaimer: This review is based on publicly available information. Always refer to the official HDFC Bank website for the most up-to-date terms and conditions.

Comments

Post a Comment