IDFC FIRST Wealth Credit Card: In-Depth Review & Analysis

IDFC FIRST Wealth Credit Card: A Detailed Review

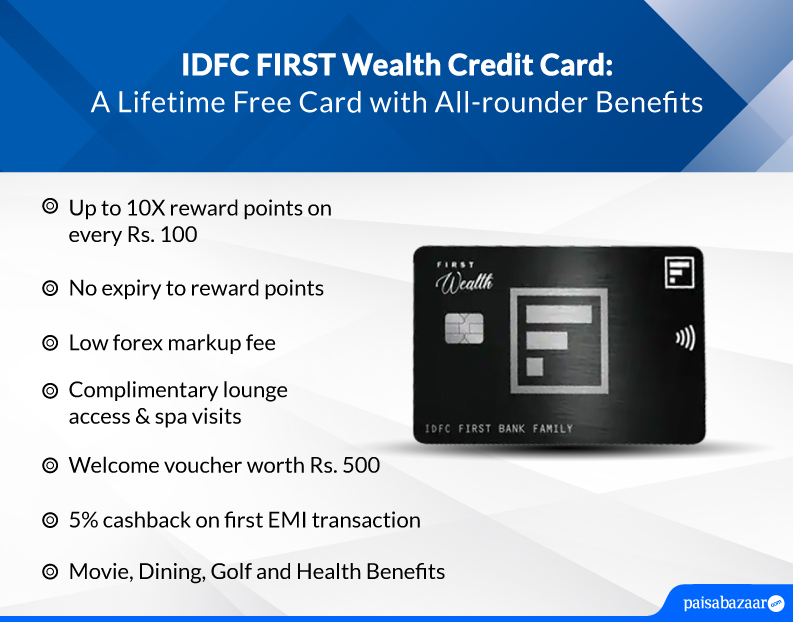

The IDFC FIRST Wealth Credit Card is a unique offering targeting high-earning individuals (annual income of ₹36 lakhs or more). Its most attractive features are its lifetime free membership and non-expiring reward points, features typically associated with premium, fee-based cards. However, a recent devaluation has impacted its reward program, making it crucial to assess if it aligns with your spending habits and financial goals.

Key Features and Benefits

Rewards Program

The reward structure is tiered:

- 3x reward points per ₹150 spent up to ₹20,000 per month.

- 10x reward points per ₹150 spent on incremental spends above ₹20,000 per month.

- 10x reward points per ₹150 spent on birthday spends.

- 3x reward points per ₹150 spent on rental and property management transactions.

- 3x reward points per ₹150 spent on education, wallet loads, and government services (these do not count towards the 10x threshold).

- 1x reward point per ₹150 spent on utility bill payments and insurance (1% transaction charge on utility bill payments above ₹20,000).

Reward points are redeemable at a rate of 1 point = ₹0.25. This redemption value is relatively low compared to other premium cards. Note that fuel, EMI transactions (except the first EMI cashback), and cash withdrawals are not eligible for reward points.

Travel Benefits

- Low forex markup fee of 1.5%.

- 2 complimentary domestic airport lounge visits per quarter.

- 2 complimentary international airport lounge visits per quarter (requires spending ₹20,000 in the previous month).

- Air Accident Cover of ₹1 crore, Personal Accident Cover of ₹10,00,000, and Lost Card Liability Cover of ₹50,000.

- Comprehensive Travel Insurance Cover of USD 1200.

- Cancellation for any reason (CFAR) insurance for 2 claims up to ₹10,000 each for hotel and flight booking cancellations.

Lifestyle Benefits

- Buy one, get one offer on movie tickets (up to ₹250) twice per month via the Paytm app.

- Access to 300+ offers from top merchants.

- Up to 20% discount at 1500+ restaurants.

- Up to 15% discount at 3000+ health & wellness outlets.

- 2 complimentary golf rounds per month for every ₹20,000 of monthly statement spends.

- Fuel surcharge waiver of 1% (up to ₹400 per month) on transactions between ₹200 and ₹5000.

- EMI conversion facility for transactions above ₹2,500.

Fees and Charges

| Particulars | Fee/Charges |

|---|---|

| Joining Fee | NIL |

| Annual Fee | NIL |

| Cash Advance Fee | ₹199 per transaction |

| Over Limit Fee | 2.5% of overlimit amount, subject to a minimum charge of ₹550 |

| Finance Charges | 0.75% to 3.65% per month, or 9% to 43.8% p.a |

| Forex Markup Fee | 1.5% for all international transactions |

| Reward Redemption Fee | ₹99 |

| Late Payment Fee | 15% of unpaid dues, subject to a minimum of ₹100 and a maximum of ₹1,300 |

Use Cases and Recommendations

Let's illustrate the card's benefits with some examples:

| Spending Category | Spending Amount | Reward Points Earned | Cashback/Value |

|---|---|---|---|

| Online Shopping (below ₹20,000 monthly limit) | ₹10,000 | 200 | ₹50 (₹0.25/point) |

| Online Shopping (above ₹20,000 monthly limit) | ₹30,000 | 2000 | ₹500 (₹0.25/point) |

| Birthday Dinner | ₹5,000 | 333 | ₹83 (₹0.25/point) |

| International Trip (Flights & Hotels) | ₹1,00,000 | 667 (Assuming ₹20,000 spent within India, 80,000 Spent International) | ₹167 (₹0.25/point) + 1.5% Forex Markup Savings |

| Rent Payment | ₹20,000 | 200 | ₹50 (₹0.25/point) |

Recommendations: The IDFC FIRST Wealth Credit Card is best suited for high-net-worth individuals who prioritize a lifetime-free card with basic rewards and travel benefits. If maximizing reward points and redemption value is your primary concern, cards with annual fees and higher reward rates might be more beneficial.

Disclaimer: This review is based on publicly available information. Terms and conditions are subject to change. Always refer to the official IDFC FIRST Bank website for the most up-to-date details.

Comments

Post a Comment