HPCL Super Saver vs IDFC Power+: Which Fuel Credit Card Reigns Supreme?

HPCL Super Saver vs IDFC Power+: Which Fuel Credit Card Reigns Supreme?

Choosing the right fuel credit card can significantly impact your savings. This detailed comparison of the ICICI HPCL Super Saver Credit Card and the IDFC HPCL First Power Plus Credit Card will help you decide which one best suits your needs.

ICICI HPCL Super Saver Credit Card

The ICICI HPCL Super Saver Credit Card offers a compelling proposition for everyday fuel users. Let's delve into its features:

- Annual Fee: ₹500 + GST

- Fuel Benefits: 4% cashback on fuel up to ₹200 per month + 1% fuel surcharge waiver.

- Additional Cashback: 1.5% extra cashback through HP Pay app (Happy Coins).

- Other Rewards: 5% cashback (Payback Points) on utility and grocery bills up to ₹100 per month.

- Movie Benefits: 25% discount on movie tickets (minimum 2 tickets) twice a month.

- Lounge Access: 1 lounge access per quarter (spend requirements apply).

- Welcome Bonus: 2,000 Reward Points and ₹100 cashback on the first fuel transaction.

Drawbacks: Redemption fees may apply; credit limit increase can be difficult; reward caps exist.

Image Credit: YouTube

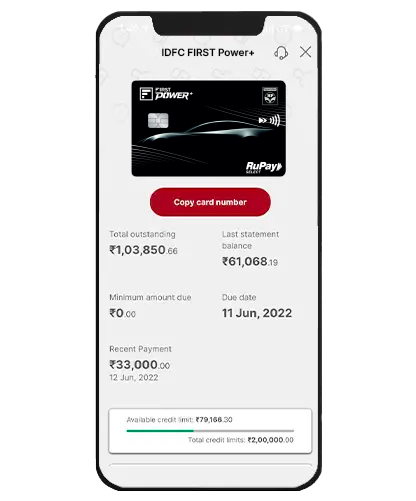

IDFC HPCL First Power Plus Credit Card

The IDFC HPCL First Power Plus Credit Card presents a strong alternative, especially for those seeking broader rewards.

- Annual Fee: ₹499 + GST (waived on high annual spending).

- Fuel Benefits: Earn 30 Reward Points for every ₹150 spent on HPCL fuel.

- Additional Rewards: 30 Reward Points for every ₹150 spent on FASTag recharges, groceries, and utilities.

- Other Rewards: 3 Reward Points for every ₹150 spent on retail purchases and UPI.

- Movie Benefits: 25% discount on movie tickets via Paytm.

- Lounge Access: Complimentary airport lounge access per quarter (high monthly spending required).

- Welcome Bonus: Up to ₹500 cashback on the first fuel transaction, cashback on first EMI transaction, and discount on Zoomcar rentals.

Drawbacks: Reward points per rupee spent are lower than ICICI card on fuel for some users.

Image Credit: IDFC FIRST Bank

Feature Comparison

| Feature | ICICI HPCL Super Saver | IDFC HPCL First Power Plus |

|---|---|---|

| Annual Fee | ₹500 + GST | ₹499 + GST |

| Fuel Reward Rate | 4% cashback + 1% surcharge waiver | 30 RP per ₹150 spent |

| Other Reward Rate | 5% on utilities/grocery (up to ₹100), 2 RP per ₹100 retail | 30 RP per ₹150 on FASTag, groceries, utilities; 3 RP per ₹150 retail/UPI |

| Movie Benefits | 25% up to ₹100 (min 2 tickets), twice a month | 25% up to ₹100 per month |

| Lounge Access | 1 per quarter (spend requirements apply) | 1 per quarter (spend requirements apply) |

| Welcome Bonus | 2000 RP + ₹100 cashback | Up to ₹500 cashback + other offers |

Use Cases

Let's analyze how these cards perform in real-world scenarios:

Scenario 1: Monthly Fuel Spend of ₹3000

| Card | Fuel Cashback/Points | Other Rewards (estimated) | Total Savings |

|---|---|---|---|

| ICICI HPCL Super Saver | ₹120 + ₹30 (surcharge waiver) | ₹50 (grocery/utility) | ₹200 |

| IDFC HPCL First Power Plus | 60 RP (approx. ₹15) | ₹15 (grocery/utility estimated) | ₹30 |

In this scenario, the ICICI card provides significantly higher savings.

Scenario 2: Monthly Fuel Spend of ₹10,000, High Grocery Spending

| Card | Fuel Cashback/Points | Other Rewards (estimated) | Total Savings |

|---|---|---|---|

| ICICI HPCL Super Saver | ₹200 + ₹100 (surcharge waiver) | ₹100 (grocery/utility) | ₹400 |

| IDFC HPCL First Power Plus | 200 RP (approx. ₹50) | ₹100 (grocery/utility estimated) | ₹150 |

Again, the ICICI card offers more savings with higher fuel spending.

Remember that these are estimates, and actual rewards may vary.

Apply Now for ICICI HPCL Super Saver Apply Now for IDFC HPCL First Power Plus🔥 Exclusive Deal Alert! 🔥

Upgrade your style with this sleek and secure Card Wallet! 💳✨

🔥 Exclusive Deal Alert! 🔥

Get the Flipkart Axis Bank Credit Card and earn rewards! 🚀💳

Comments

Post a Comment