Axis Magnus Credit Card: A Detailed Review

Axis Magnus Credit Card: A Detailed Review

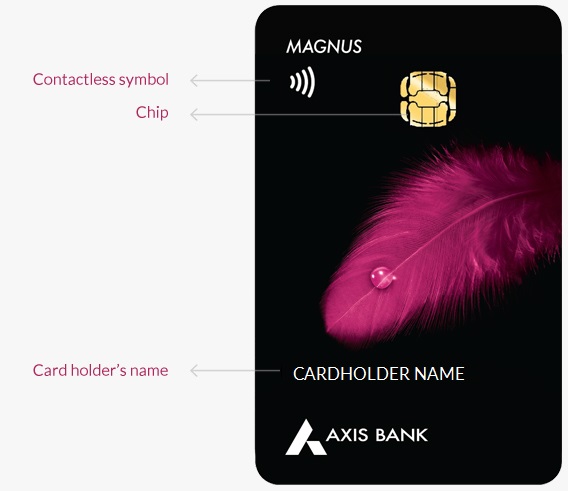

The Axis Magnus Credit Card is a super-premium offering from Axis Bank, designed for high-income individuals seeking a luxurious lifestyle with significant rewards and benefits. This in-depth review will explore its features, benefits, drawbacks, and help you determine if it's the right fit for you.

Key Features and Benefits

The Axis Magnus card boasts a range of benefits across various spending categories, focusing on travel, dining, and shopping. Key features include:

- Welcome Benefit: Choose a gift voucher worth ₹12,500 from Luxe, Yatra, or Postcard Hotels.

- Rewards Rate: 12 Axis EDGE REWARDS Points for every ₹200 spent (up to ₹1.5 Lakhs monthly). Earn 35 RPs per ₹200 above that limit. 5X EDGE REWARDS on travel spends via TRAVEL EDGE.

- Reward Redemption: Redeem Axis EDGE REWARDS Points on the EDGE REWARDS portal (1 Edge Reward = ₹0.20) or transfer to partner airline/hotel programs.

- Unlimited Domestic & International Lounge Access: Enjoy complimentary access to various airport lounges globally with Priority Pass (8 guest passes per year for the primary cardholder).

- Oberoi Hotel Discounts: Avail discounted stays at Oberoi Hotels.

- Dining Discounts: Up to 40% discount (up to ₹1000) at participating restaurants through Axis Bank Dining Delights.

- Insurance Benefits: Credit shield protection worth ₹5 lakh and purchase protection worth ₹2 lakh.

- Low Forex Markup Fee: Only 2% on international transactions.

- No Cash Withdrawal Charges: (Interest charges still apply)

- Annual Fee Waiver: Waived off on spending ₹25 lakhs or more annually.

Fees and Charges

| Fee/Charge | Amount |

|---|---|

| Joining Fee | ₹12,500 + GST |

| Annual Fee | ₹12,500 + GST (waived on ₹25 Lakhs spend) |

| Foreign Currency Markup | 2% |

| Cash Advance Charges | Nil (Interest charges apply) |

| Interest Rate | 3.0% per month (42.58% annually) |

Axis Magnus Credit Card: Use Cases and Recommendations

Let's explore how the Axis Magnus card benefits different users:

| User Type | Spending Scenario | Estimated Rewards/Cashback |

|---|---|---|

| Frequent International Traveler | ₹1,00,000 spent on flights and hotels via Travel Edge | 50,000 EDGE Reward Points (₹10,000 value) + Lounge Access |

| Business Owner (High Spender) | ₹2,50,000 spent on business expenses | 1,25,000 EDGE Reward Points (₹25,000 value) + Potential Annual Fee Waiver |

| Luxury Dining Enthusiast | ₹50,000 spent on dining at participating restaurants | 25000 EDGE Reward Points (₹5000 value) + Dining discounts worth up to ₹10000 based on deals |

Recommendations: The Axis Magnus card is ideal for high-net-worth individuals with significant spending power who frequently travel internationally and value premium services like airport lounge access and exclusive dining discounts. The high annual fee is justified only with significant spending exceeding the waiver threshold.

Drawbacks

- High Annual Fee: ₹12,500 + GST is a substantial cost.

- High Income Requirement: Requires a high annual income of ₹24 lakhs.

- Limited Golf Benefits: Unlike some competitor cards, it lacks golf benefits.

- Reduction in Benefits (Past Changes): Some benefits have been removed or modified over time. It's crucial to check the current terms and conditions before applying.

The Axis Magnus Credit Card, while offering premium benefits, demands a high level of spending to be worthwhile. It is essential to carefully evaluate your spending habits and compare it with competing cards to determine suitability.

🔥 Exclusive Deal Alert! 🔥

Upgrade your style with this sleek and secure Card Wallet – designed for ultimate convenience and durability! 💳✨

🔥 Exclusive Deal Alert! 🔥

Get pre-approvedoffer for the Flipkart Axis Bank Credit Card and unlock amazing rewards, cashback, and exclusive offers! 🚀💳

Comments

Post a Comment