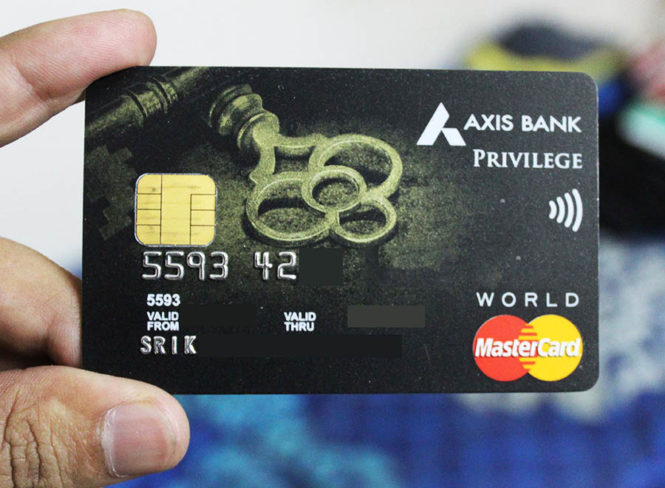

Axis Bank Privilege Credit Card: A Detailed Review

Axis Bank Privilege Credit Card: A Detailed Review

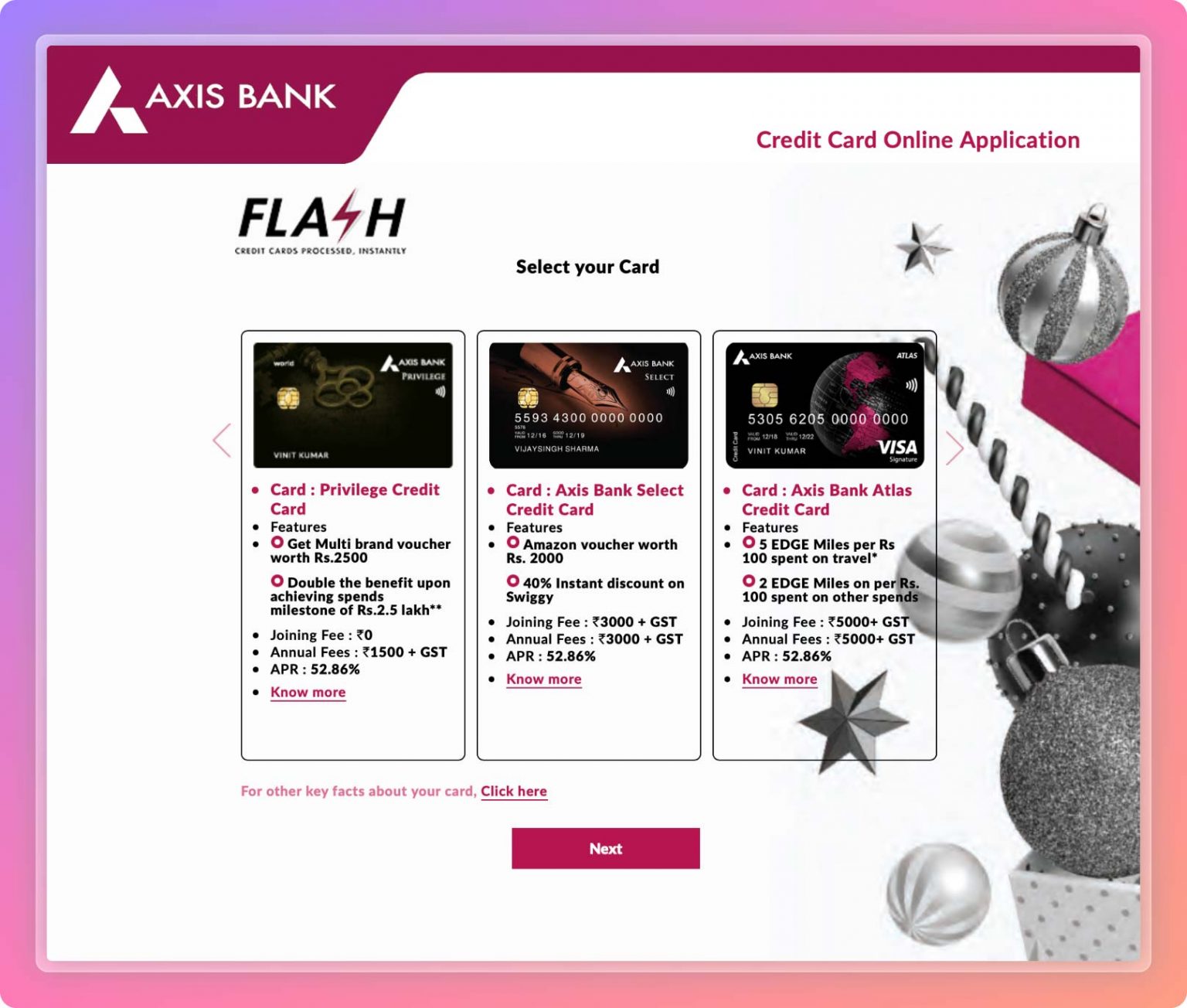

The Axis Bank Privilege Credit Card is designed for individuals who value travel and shopping experiences. While it boasts a lifetime free option for priority banking customers, it carries a joining fee of ₹1,500 + GST for others. This review delves into its features, benefits, drawbacks, and overall suitability for different users.

Key Features and Benefits

- Welcome Benefit: 12,500 EDGE Reward Points (worth ₹2,500) upon meeting spending requirements within the first 60 days.

- Rewards Rate: Earn 10 EDGE Reward Points for every ₹200 spent (excluding certain categories).

- Dining Benefits: Up to 20% discount at 4,000+ partnered restaurants.

- Lounge Access: 2 complimentary visits to domestic airport lounges per calendar quarter (subject to spending requirements).

- Insurance Coverage: Air accident insurance, lost/delayed baggage coverage, lost travel document coverage, and purchase protection.

- Renewal Fee Waiver: Renewal fee waived if annual spending exceeds ₹5 lakhs.

- Fuel Surcharge Waiver: 1% waiver on fuel transactions between ₹400 and ₹4,000.

Fees and Charges

| Fee/Charge | Amount |

|---|---|

| Joining Fee | ₹1,500 + GST (Waived for Priority Banking Customers) |

| Annual Fee | ₹1,500 + GST (Waived if annual spending exceeds ₹5 lakhs) |

| Cash Advance Fee | ₹500 or 2.5% of the withdrawn amount, whichever is higher |

| Foreign Currency Markup | 3.5% + GST |

| Interest Rate | 3.75% per month (55.55% per annum) |

Use Cases and Recommendations

Let's explore how the Axis Bank Privilege Credit Card might benefit different users. The value proposition hinges largely on exceeding the ₹5 lakh annual spending threshold to waive the annual fee and maximize reward point earning.

| User Type | Spending Scenario | Estimated Rewards/Benefits |

|---|---|---|

| Frequent Traveler | ₹100,000 on flights and hotels; ₹50,000 on other travel expenses; ₹10,000 on dining; ₹30,000 on other expenses | 5000 EDGE Reward points + 8 free domestic lounge visits (if spending requirement met each quarter) + potential dining discounts |

| Business Professional | ₹200,000 on client entertainment; ₹150,000 on travel; ₹50,000 on other business expenses | 10,000 EDGE Reward Points + potential dining discounts + possible renewal fee waiver |

| High-Spending Shopper | ₹500,000 on shopping; ₹100,000 on dining; ₹50,000 on travel | 25000 EDGE Reward points + potential dining discounts + renewal fee waiver |

Recommendation: This card is ideal for high-spending individuals who frequently dine out, travel domestically, and value reward points. If you consistently exceed ₹5 lakhs in annual spending, the value proposition is strong. However, for those with lower spending habits, the annual fee might outweigh the benefits.

Comparison with Other Cards

The Axis Bank Privilege Credit Card competes with other premium cards like the HDFC Regalia Gold and SBI PRIME. While the Axis Bank card offers a competitive rewards program, the lack of international lounge access might be a drawback compared to some competitors. A detailed comparison table would be beneficial but requires more data on competitor cards from the given context.

🔥 Exclusive Deal Alert! 🔥

Upgrade your style with this sleek and secure Card Wallet – designed for ultimate convenience and durability! 💳✨

🔥 Exclusive Deal Alert! 🔥

Get pre-approvedoffer for the Flipkart Axis Bank Credit Card and unlock amazing rewards, cashback, and exclusive offers! 🚀💳

Comments

Post a Comment